|

|

|

|

#1 |

|

Участник

|

dynamicsax-fico: Parallel accounting according to the “Cost of Sales” and “Nature of Expense” accounting method (1)

Источник: https://dynamicsax-fico.com/2016/06/...ting-method-1/

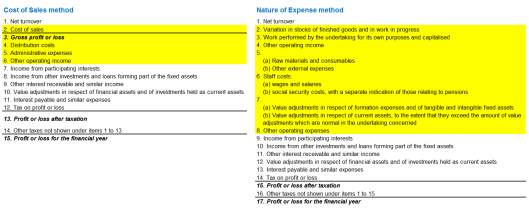

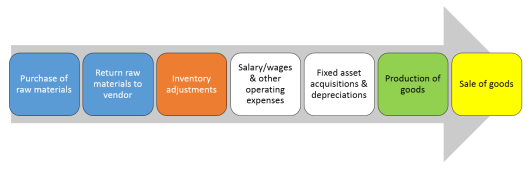

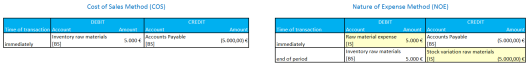

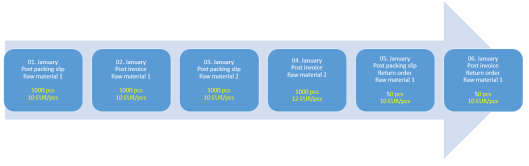

============== International operating companies are often required to prepare financial statements that follow different accounting methods/regulations. Especially local units of international business conglomerates that operate in a foreign country regularly have to prepare financial statement in one format for local accounting standard setters and in a different format for corporate headquarters. In the European Union you will often face situations where companies have to prepare financial statements according to the so-called “Cost of Sales” (COS) Method for corporate headquarters and according to the “Nature of Expense Method” (NOE) for local accounting bodies / tax offices. Within the following subsections I will illustrate how both methods – the COS and the NOE method – can be setup in parallel in Standard Dynamics AX. Before digging into details, let’s have a look at the major differences between the COS and NOE accounting method. A. Overview major differences between the COS and NOE accounting method In the European Union (EU) different regulations are applicable when it comes to the use of COS and the NOE accounting method. As an example, the EU directive 2013/34 specifically describes both methods in detail by referring to the “Function of Expense” (COS) and “Nature of Expense” (NOE) method. Similar regulations can be found e.g. in Germany and Austria where legal regulations detail the differences and requirements of both methods. Irrespective of differences in the nomenclature, the major differences between the COS and NOE method can be recognized in the structure of a company’s Income Statement. The next screen-print compares those structures by showing the COS method on the left and the NOE method on the right.  Despite the summarized comparison of the different Income Statement formats, major differences can be identified in the inventory, human resource and fixed asset sections. From a finance & controlling perspective, an important difference between the COS and NOE method is related to the data sources required for generating both financial statement formats. That is, while the NOE method does only require data from the accounting department, the COS method also requires cost / management accounting information in order to break down the costs by functions. The next subsection details the sample data used for the illustrations shown in this post. This section is followed by a in depth specification of setups required in Dynamics AX and their effects on corporate financial statements. B. Sample data To illustrate you the differences between the COS and NOE method, a number of transactions have been recorded that are based on the following process flow:  The process flow that you can identify from above starts with the purchase of raw materials, which are later on partly returned to the vendor (due to quality problems). The next transactions are related to inventory adjustments in the warehouse. Thereafter, several transactions originating from the non-operating/administrative areas will be illustrated before the differences in the production process of finished goods will be explained in detail. The process flow finally ends with the investigation of the differences in regards to the sale of the produced goods. C. Process illustrations In the following, each of the different colored elements shown in the prior process flow diagram will be analyzed and explained in separate sub-chapters. C.1. Purchase & return of materials For purchase related material transactions, the major difference between the COS and NOE method is that the COS method does not affect a company’s Income Statement and thus its profit whereas the NOE method initially expenses the complete purchase of the materials. As a result, the company’s profit instantly decreases when the NOE method is applied. If nothing else happens with the materials (that have been purchased) over the period, the profit reduction is subsequently offset by an adjustment (so-called “stock variation”) transaction. The next screen-print illustrates the differences between both methods just described in an accounting like format.  What can be identified from the COS method transactions shown on the left-hand side of the prior illustration is that the purchase of materials does only affect the company’s Balance Sheet (BS). The NOE method related transactions do on the other hand side – at least temporarily and depending on changes that occurred to stock levels over the month – also influence a company’s Income Statement (IS). From what has been said so far, two major disadvantages of the NOE method can be identified.

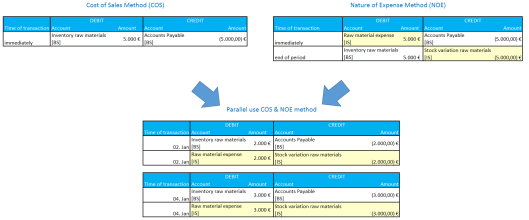

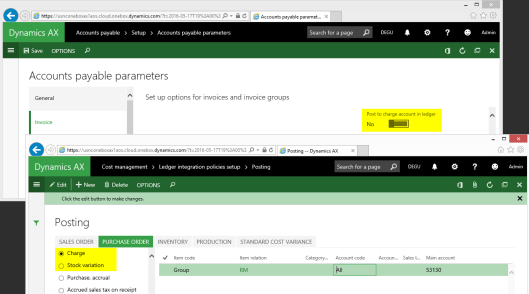

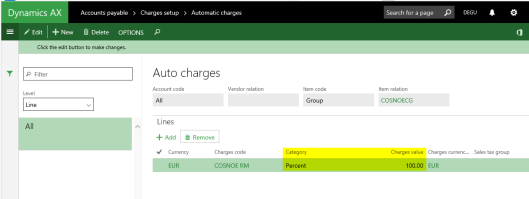

Irrespective of the disadvantages mentioned and against the background of the accounting transactions illustrated in the prior screen-prints, the question arises how the COS and NOE method can be aligned with each other in a way to get both Income Statement formats out of Dynamics AX in parallel? The following illustration tries answering this question by showing you that both accounting methods can be aligned with each other through an additional and parallel expense and stock variation transaction (highlighted in yellow color). Please see the lower part in the next illustration.  Given that our company creates two purchase orders – one for 2 TEUR and a second one for 3 TEUR – two additional “stock variation transactions” are recorded. The major difference to what has been explained before is thus the number of stock variations recorded. That is, rather than posting a single “large” stock variation transaction at the end of the month, several “small” stock variation transactions are recorded with each and every purchase. A major advantage of this procedure is that there is no need for a (manual) analysis and recording of stock variations at the end of the month, which frees up some time for doing other things during the often busy month end closing period. Note: The ledger accounts used for the additional material expense and stock variation postings debit and credit Income Statement accounts. As a result, no effect on a company’s profit arises. For the preparation of an Income Statement according to the COS method this result thus implies that assigning both accounts to the same Income Statement section will not influence a company’s profitability, KPI’s, etc. After investigating how the COS and NOE method can be aligned with each other in a way to generate the transactions required for both accounting methods, the questions arises how to setup Dynamics AX in order to get those additional material expense and stock variation postings automatically recorded? From a “technical” Dynamics AX perspective, the following two options might help getting those additional postings recorded. Option 1: Activate the “post to charge account in ledger” AP parameter The first option makes use of the “post to charge account in ledger” parameter that can be found in the Accounts Payable parameters form. Activating this parameter results in an additional charge (expense) and stock variation posting on the ledger accounts specified in the respective sections of the inventory posting matrix illustrated below.  On first sight, this seems to be exactly what is needed for a parallel use of the COS and NOE method. Yet, a detailed investigation of this functionality shows that the additional posting triggered through the activation of this parameter only applies to ordinary purchase related transactions but not to vendor return transactions. Because of this shortcoming, this first setup option won’t be used in the following. Option 2: Make use of automatic charge codes Due to the limitations of the first option, an automatic charge code is used instead. The next screen-prints illustrates the setup of this charge code that debits an expense account and credits a stock variation account.  Once the charge code is setup, it is linked to an automatic charge in order to generate an additional posting equivalent to the one created for the materials purchased. This requires that an automatic charge percentage of 100% is applied, as illustrated in the next screen-print.  In order to enable you tracking what has been mentioned above, the following purchase order related transactions are recorded in a Dynamics AX demo environment:

To be continued in part (2) Filed under: Accounts Payable, Accounts Receivable, Fixed Assets, General Ledger, Inventory Tagged: Cost of Sales Method, Nature of Expense Method, Posting setup, Profit & Loss Statement Источник: https://dynamicsax-fico.com/2016/06/...ting-method-1/

__________________

Расскажите о новых и интересных блогах по Microsoft Dynamics, напишите личное сообщение администратору. |

|

|