|

|

#1 |

|

Участник

|

dynamicsax-fico: “Shadow Accounting” in Dynamics AX using the example of silent factoring

Источник: https://dynamicsax-fico.com/2016/05/...ent-factoring/

============== Within this post I want to demonstrate you the use of a shadow accounting system based on the example of silent factoring. What makes silent factoring special is the fact that a company sells its receivables, which consequently disappear from its books. At the same time the company still needs to manage and track the receivables and payments made by their customers in their (accounting) system. How Dynamics AX can support you in implementing such a shadow accounting system will be exemplified next based on the following process flow:

Notes:

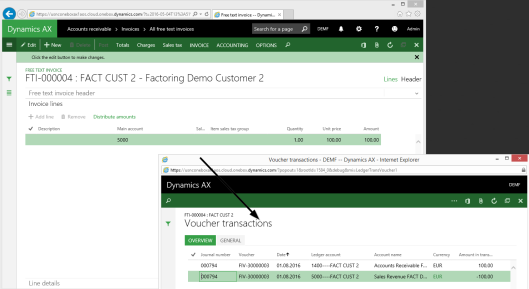

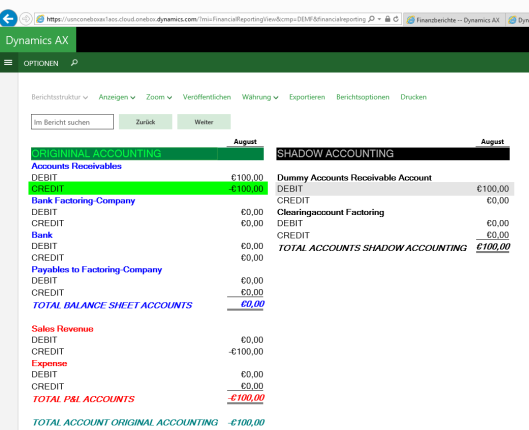

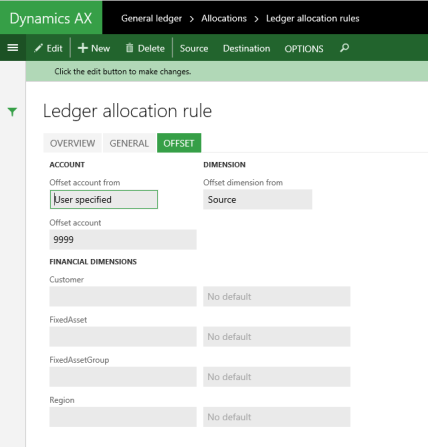

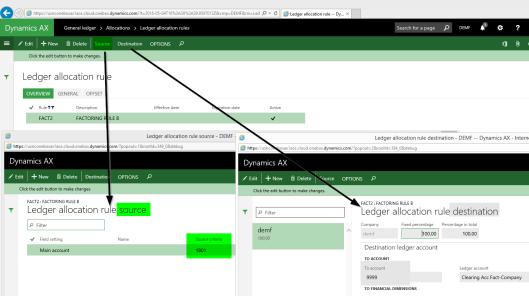

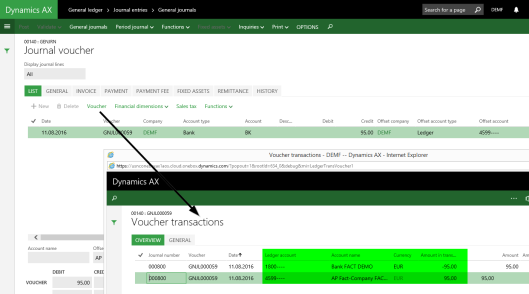

Step 1: Post customer free text invoice for 100 EUR Initially, a free-text invoice for a total amount of 100 EUR is recorded in Dynamics AX. Recording this invoice generates postings on ledger accounts no. 1400 (Accounts Receivables) and ledger account no. 5000 (Sales revenue) within the original accounting books.  Step 2: Transfer of the open customer position to the “shadow accounting book” The next process step involves the transfer of the open customer position to a dummy customer account. As the dummy customer account is setup with a summary account (no. 9499) that belongs to the shadow accounting system, the open customer position disappears from the company’s books.  The transfer of the open customer position to the shadow accounting books can be identified in the next screen-print by the green and grey highlighted lines.  A detailed investigation of the accounts illustrated in the above screen-print shows that the original and shadow accounting books do not match. That is, the total of all accounts in the original and shadow accounting books do not add up to zero. Step 2a: Process allocation request to balance original and shadow accounts What is missing in the previous screenshot is an expense transaction that offsets the reduction in the open customer position (receivable). The same holds for the transaction that is recorded in the shadow accounting book. To get the missing transaction into Dynamics AX, the following allocation rule is setup:

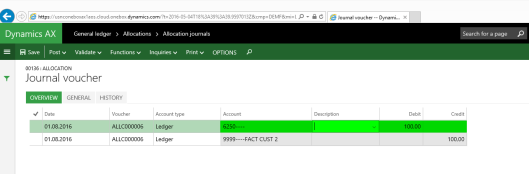

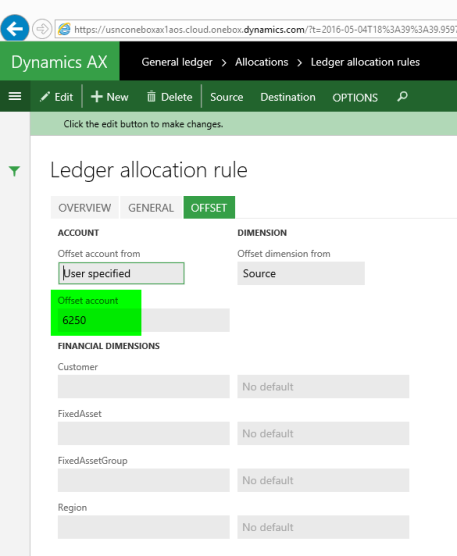

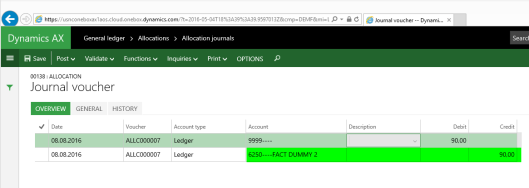

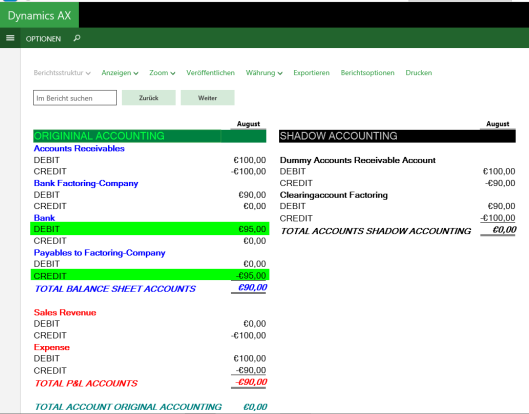

Processing this allocation rule results in the following voucher …  … and the following account statement.  The screen-print above shows that the original and shadow accounting books are now balanced. Step 3: Record the 90 EUR payment receipt of the factoring company for the sale of the receivables The third process step is related to the receipt of the amount that the factoring company pays us for the sale of the receivable. In the example used, a total of 90 EUR is paid by the factoring company and posted on our bank account. The offset account used is the dummy factoring account from the shadow accounting book. For details, please see the next screen-print.  After recording the money received from the factoring company, the original and shadow accounting books do – once again – not balance and show a total amount of +90 EUR respectively -90 EUR.  Step 3a: Process allocation request to balance original and shadow accounts To align both accounting worlds – original & shadow accounting – another allocation rule is setup and processed. This second allocation rule uses the transactions recorded on the factoring bank account no. 1801 as the basis for generating a posting on the shadow clearing account no. 9999.  The offset account is the P&L account no. 6250 that was already used in the first allocation rule before. That is because the receipt of the money from the factoring company does not only result in an increase of your bank account balance but does also require a corresponding offset P&L account transaction. Otherwise the expense amount of 100 EUR recorded with the first allocation rule would not correctly represent the “loss” (10 EUR) that we make from selling a 100 EUR receivable for 90 EUR.  Based on the setup shown above, the second allocation rule results in the following voucher…  … that ensures that both accounting worlds do again balance.  (Note: If you post the transfer of the open customer invoice to the shadow accounting books (step 2) and the payment receipt from the factoring company (step 3) at the same time, the setup and processing of the first allocation rule is sufficient to get the original and shadow accounting books balanced. In the example used two allocation rules are required because of a timing difference between step 2 and step 3. Whether you will need to setup a single or several allocation rules thus depends on the specific organizational process flow in your organization). Step 4: Customer transfers 95 EUR to our company’s bank account After a while the customer finally makes a payment of 95 EUR to our ordinary bank account.  As we record this receipt on main accounts that do all belong to the original accounting book, both accounting worlds balance.  Step 5: We transfer the customer payment received to the factoring company The last process step involves forwarding the money we received to the factoring company. As this final transaction involves once again only accounts from the original accounting system, everything balances. For details, please see the next screen-prints.   Summary The shadow accounting example illustrated in this post can be used for several other accounting scenarios. The important thing to make this work is setting up and processing allocation rules. Whether one single allocation rule – that is processed e.g. at month-end – is sufficient or whether several allocation rules are required highly depends on your organizational process flows and time gaps that might exist between the different process steps. Filed under: Accounts Receivable Tagged: Factoring, Sale of receivables, Shadow accounting Источник: https://dynamicsax-fico.com/2016/05/...ent-factoring/

__________________

Расскажите о новых и интересных блогах по Microsoft Dynamics, напишите личное сообщение администратору. |

|

|

|

|

|